The capital market are by definition optimistic in their outlook, until reality or a crisis or just fear take over, since as in 1927, 1987, 2001 and 2008 (there were others...but these are either recent or well known), the market is looking expensive. The most well know index for valuation of the market is the CAPE which stands for cyclically adjusted price earning ratio; It stands today only second (in level) to that of 1927 and 2000)

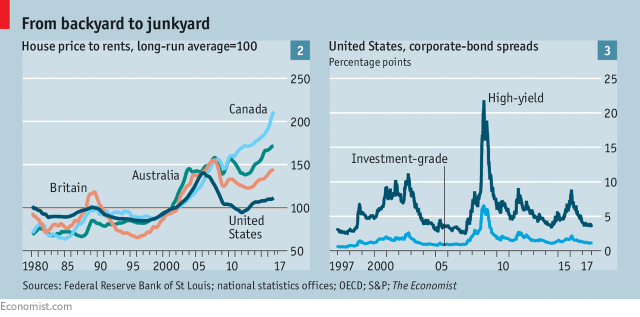

First the market has been uneven for a long time; the majority of the S&P500 has generated pedestrian returns for investors -- aside from Tech the market has done little to impress Five companies account for fully 30% of the market's rise over the past 3 years. So is the market in a bubble? I don't know anymore because ALL asset classes have seen massive increase in value (reduction in yield). From housing, to bonds to equity -- everything is up. In fact, since January 1, the market is up nearly 14% -- no bad for a economy that has seen GDP growth of 2.4%, and interest rates of 2% on 10 year Treasury bonds (its a bit higher now at 2.3% now)

Some of my younger friends are keen to get into the property ladder with the expectation that they will make good returns over years. Using these property income to meet their loan repayment obligations and overhead costs -- building equity in their assets over years and years. There are many assumptions here:

First the market has been uneven for a long time; the majority of the S&P500 has generated pedestrian returns for investors -- aside from Tech the market has done little to impress Five companies account for fully 30% of the market's rise over the past 3 years. So is the market in a bubble? I don't know anymore because ALL asset classes have seen massive increase in value (reduction in yield). From housing, to bonds to equity -- everything is up. In fact, since January 1, the market is up nearly 14% -- no bad for a economy that has seen GDP growth of 2.4%, and interest rates of 2% on 10 year Treasury bonds (its a bit higher now at 2.3% now)

Some of my younger friends are keen to get into the property ladder with the expectation that they will make good returns over years. Using these property income to meet their loan repayment obligations and overhead costs -- building equity in their assets over years and years. There are many assumptions here:

- That their property will rise in value

- That their rental income will match their outflow needs

- What is forgotten is when an apartment is empty or the tenant doesn't pay

- what about taxes! They are going up all the time, at level that far exceed inflation

- Maintenance costs can be high

And the number for Canada are scary, bellow is a video using US housing prices (pre-2008) Canada is far far worse than the US...

Back to our potatoes -- the market is clearly not cheap, but it could still go up for a little while. What is scary is that all asset classes seem to be going the same way. There is a historical high saving ratio (from the baby boomers) and a lack of investment opportunity in the OECD, which depresses interest rates.

Interest rate (real) are at or near zero -- the search for yield has even allowed Argentina to issue a 100 year bond...at attractive pricing. That's from a country that has defaulted 6 times in the past 110 years.

So the conclusion is complex, yes yields are low because there is such demand for investment opportunities. Can it go on? yes, Canadian real estate is less clear since the economy is slowing, but interest rates have nowhere to go (they are close to zero as we speak) so there will be no real stimulation. Government spending is helping push up GDP but there is a limit to what can be achieved. It remains that a market trading at these levels baggs the question of what can happen? Because, all asset classes have gone up! There is no room for safety (US gov't bonds maybe). All boats have been lifted over the last few years.

Buyers beware!

Comments