In March 2014 I wrote:

I wrote this three years ago, and although today Malls are in real trouble, it took much much longer than anticipated to go from being a negative trend to a route. On the bright side there is virtually no (economical) way these days to short REITs, but should you have taken a position 3 years ago, the red ink of the trade would have killed you.

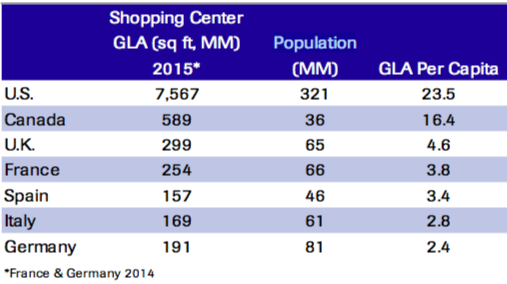

OK it is well know that America has a special love for Malls -- years ago I was given direction to a restaurant (sports bar) as "Look its just over there -- two malls to the right, and you will find it!". This morning the Atlantic had a piece on Malls, and showed an interesting statistic:

The economics have changed the smart money has moved on. So the markets are freaking out! Moreover that's for the housing prices, considering the damage that Amazon is doing to the average mall (without generating any real profits) it amazes me how well commercial real estate income trust continue to perform. I cannot remember the last time I bought goods in a store. So the malls are dying and real estate is back in trouble. However, this time around the guys suffering are hedge funds and their "rich" investors-- and not the banks. My guess is that Congress will pass new "hedge fund saving legislation" very quickly. After all, you got to support the guy who got you elected.

I wrote this three years ago, and although today Malls are in real trouble, it took much much longer than anticipated to go from being a negative trend to a route. On the bright side there is virtually no (economical) way these days to short REITs, but should you have taken a position 3 years ago, the red ink of the trade would have killed you.

OK it is well know that America has a special love for Malls -- years ago I was given direction to a restaurant (sports bar) as "Look its just over there -- two malls to the right, and you will find it!". This morning the Atlantic had a piece on Malls, and showed an interesting statistic:

Cannot think of better proof that there are too many Malls -- but the reality is that its been a long and on going trend. The article goes on to say that there are two trends:

(1) People do their research on-line

(2) People buy more on line

These are not the same thing, in the past, shoppers would go to a mall several times to investigate the purchase of a large good -- sofa was their example, each time they would be side-tracked and do other purchase (new shoes etc etc). Now the research is done on line -- because often the store doesn't have the "knowledge" and they arrive in the store ready to make the "big purchase". All these side trips are gone. The chain stores have made sure that this was going to be the inevitable conclusion; be reducing staffing levels (cost) and high turnover insured that they staff knew little if anything about the goods they were selling -- they often had to go on the internet to find the color of fabric...

People buy massively more online, Amazon grew from $16 billion in sales (2010) to nearly $80 billion in sales today -- to give a scope to that, its equivalent to 4 times Sears sales...

The direction of the mall (or the store) can only go one way -- down. Another technology that I cover, self driving cars. Lets say that you want specific medicine, and instead of going to the nearest drug store, the drug store comes to you -- its physical presence is a truck -- or van.

America's baby boomers are retiring and changing their shopping habits -- the millennials have very different demands -- try pawning off a sofa to your son or daughter, a dare you! They want less stuff, regularly unclutter their lives -- granted when they have children it changes a little, still they remain frugal in their consumption.

Back to my story, I was right, absolutely right in 2014, that the great retail bonanza of the 1990 was over, I didn't get how long it would take for all these stores to give up the ghost, and that as a trader can be the biggest mistake!

Comments